Groundbreaking Toolkit (100 page whitepaper +Etemplates) That Fixes Forecasting Nightmares – (Late nights, errors, too much detail)

If your forecasting is a nightmare, of long nights, Excel spreadsheet error messages and praying that the resulting numbers are right you need to read this paper. This white paper sets out the foundation stones of a rolling forecast process and how to move from annual planning to a quarterly rolling planning process. The secrets of rolling planning are revealed at last. In addition to the white paper you get a comprehensive tool-kit for a fast start including checklists, selling the change presentation, and workshop materials. Find out more about the toolkit (white paper and electronic media)

Re-forecasting the year-end position every month is flawed on a number of counts, it never looks further than year-end, each month the forecast changes creating number noise, the opportunity to set realistic reporting targets for the on-coming quarter is not taken up, the forecast model frequently is based in error prone Excel, and seldom do budget holders buy-in to the forecast as they were not involved in the numbers.

Does this sound familiar? If so, read:

- The 10 benefits of quarterly rolling forecasting process

- How to sell quarterly rolling forecasting to the C-Suite

- The 14 Foundation stones of a quarterly rolling forecast process

- Seven tips to speed up planning and forecasting

- 12 lessons learnt when implementing rolling forecasting

- 4 rules for accurate revenue forecasting

- 7 Rolling forecasting templates

- 9 reasons why you should migrate from forecasting spreadsheets

- Cull all finance spreadsheets over 100 rows

- The 8 myths around annual planning

- Why annual planning and budgeting is broken

- 10 areas where spreadsheets have no place to be

- 60 forecasting and planning tool providers and their applications

- A ten slide forecasting tool sales pitch

- How to sell the move away from annual budgeting and planning

What is a rolling forecast? What is a rolling plan?

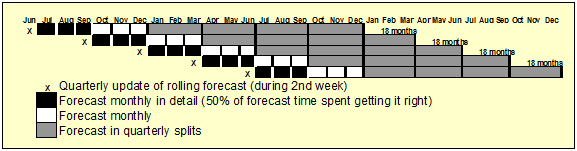

The better practice for rolling forecasting is to perform it bottom up using a quarterly process looking out between 6 – 8 quarters ahead. The quarterly forecasting process is where management sets out the likely revenue and expenditure for the next 18 months. Each quarter, before approving these estimates, management sees the bigger picture six quarters out. All subsequent forecasts while firming up the short-term numbers for the next three months also update the annual forecast. Budget holders are encouraged to spend half the time on getting the detail of the next three months right, the red zone as shown in exhibit 1, as these will become targets, on agreement. The balance of the time then to be spent forecasting the remaining next five quarters.

Each quarter forecast is never a cold start as they have reviewed the forthcoming quarter a number of times. Provided you have appropriate forecasting software, management can do their forecasts very quickly; one airline even does this in three days!! The overall time spent in the four quarterly forecasts during a given year is five weeks.

Most organisations can use the cycle set out below if their year-end falls on a calendar quarter end. Some organisations may wish to stagger the cycle say May, August, November, and February. I will now explain how each forecast works using a June year-end organisation.

Exhibit 1 How the rolling forecast works for an organisation (June year-end)

How should my finance team be performing?

Imagine your Finance team making history rather than just reporting on it. Imagine your month-end reporting being completed within 3 working days or less, your annual planning process being replaced by quarterly rolling planning, a year-end when you have the end of audit party within 3 weeks of your year-end, a happy and well function team. This website will offer you methodologies to fix the common problems in the finance team that will have a profound impact on your organisation and on your career.

We can make this a reality. I’m David Parmenter. I am the author of The Financial Controllers and CFO’s Toolkit 3 rd Edition. It is a follow-on from Winning CFOs and Pareto’s 80/20 for Corporate Accountants.

|

|

|

| Click here to read more about the book | This was the second book, now superseded by The Financial Controllers and CFO’s Toolkit 3 rd Edition | This was the first book, now superseded by The Financial Controllers and CFO’s Toolkit 3 rd Edition |

I teach how to develop winning KPIs, replace the annual planning process with quarterly rolling planning, speed up accounting processes and winning leadership. I’ve delivered workshops and key note addresses in 32 countries. Companies where I have delivered in-house workshops include European Space Agency, Australian Post, Lloyds of London, Open University, and the Singapore government (Peoples Association) and more.

Look inside the breakthrough lean finance team processes book

A look inside the book – a 25 page extract

Download the chapter 14 on “Attracting and recruiting talent”

Download the chapter 3 on “Rapid month-end reporting: by day three or less”

Download the chapter 16 on Implementing quarterly rolling forecasting and planning

Testimonials on The Financial Controllers and CFO’s Toolkit 3rd edition

Eight of the top twenty mistakes a finance team make are connected to planning and forecasting

- Allowing month-end reporting to go past three working days

- Taking months doing an annual plan – when it can be done in 10 working days

- Letting Excel dominate the finance system

- Not investing enough in accounts payable.

- Not adopting the purchasing card (a free, accounts payable system)

- Investing in a complex G/L and then upgrading it too frequently

- Having over 80 account codes for the P/L

- Budgeting at account code level

- Breaking down the annual plan into twelve before the year starts

- Giving budget holders an annual funding entitlement

- Only forecasting to year-end

- Not producing daily/ weekly decision based reports

- Producing numbing monthly financial reports

- Reporting on the wrong performance measures which can damage performance

- Selling change by logic instead of the emotional drivers of the buyer

- Using Julius Caesar’s calendar instead of 4,4,5-week months

- Spending months on the annual accounts

- Working hard but not smart

- Holding onto time wasting habits

- Not investing enough time to attract and recruit talented staff

The fixes are covered in The Financial Controllers and CFO’s Toolkit 3 rd Edition

Accessing David Parmenter’s intellectual property

David Parmenter’s Toolkits with E-Templates

If you want to access the latest thoughts of David Parmenter, buy his toolkits which are constantly updated and are a comprehensive (100 page) guide to get you to make change in the areas covered. each toolkit comes with accompanying electronic templates to get your implementation started. On time of acquisition David reviews and updates the toolkit as appropriate. These toolkits are printed, signed and posted to the purchaser.

David Parmenter’s Working Guides

For areas which are not covered by a toolkit David Parmenter has written a shorter (20- 30 pages) working guide to help you make progress. They can be read and absorbed in an hour. All you need to do is purchase them via the paypal link and I will send you the working guides are emailed with accompanying useful E-templates with 48 hours. To buy multiple guides access the special deal.

E-Templates From David Parmenter’s Best Selling The Financial Controller and CFO’s Toolkit Book

You can purchase all the electronic versions of the book templates. Once the paypal notification has been received the templates are emailed with 48 hours.

Other research materials

- strategic focus

- KPMG Planning forecasting and budgeting the future

- Rolling forecasting best practices

The ten reasons why you should stop annual planning

The time is right for quarterly rolling forecasting and quarterly rolling planning as the standard annual planning process:

- Takes too long, costs too much – too much detail and too many iterations.

- Does not help run the business as it is out of date as soon as the ink has dried

- Leads to dysfunctional behaviour, building silos and gaming the system

- Undermines monthly reporting (monthly budgets are poor targets)

- Is an anti-lean process

- Often has allocations that budget holders have no control over

- Decisions made too early and often too high up

- Prevents value adding activities that were not in the budget

- A bad yardstick for evaluating performance

- Based on planning and central control which has MacGregor’s theory X as its base – that you cannot trust people

Smart organizations do not have an annual planning process anymore. Instead, they use quarterly rolling planning.

David Parmenter

Forecasting & Planning Papers

How to Implement a Planning Tool and Get It Right First TimeWhy you need a planning tool and how to sell the concept to the senior management team

IBM have commissioned me to write two papers which are available on their website for free.