Your cart is currently empty!

12 lessons learnt when implementing rolling forecasting

By David Parmenter

These lessons have come from my implementation guide (Whitepaper + e-templates) “How to Implement Quarterly Rolling Forecasting and Quarterly Rolling Planning – and get it right first time”

I have come across a number of examples where companies have had to rebuild the forecasting model within 18 months of its commissioning, as a better understanding of the planning tools and its capabilities comes to light.

Lesson 1: Start with a blueprint

Just like painting a house implementing a planning tool is all about the preparation. One needs to build a clear blueprint about what is required.

It is important to avoid basing the planning tool on your existing Excel forecasting models. It is a common fault, one borne out of ignorance and a lack of understanding of the potential of planning tools.

One of the first steps is to interview the C-Suite to scope the key drivers and second-guess the likely questions they will want to be answered in the future from the planning tool. This can be done by brainstorming with C-Suite what they think likely future scenarios are, and then accommodate key drivers in the model design. In the Ballance case study featured in this paper, they had spent 6 weeks in workshops developing the requirements and coming up with a 140-page blueprint that ended up with the planning tool being very successful and built under budget.

Benefit of this action: maximise the capability of the planning tool

Lesson 2: Begin with the C-Suite commitment and education

The C-Suite must be committed to the rolling forecast methodology and understand why the new regime needs to be a “fast light touch” budget holder involved process, using an appropriate planning tool. One of the key contributions the C-Suite make is to help the project team understand the key drivers of the business. These drivers will tie back to strategic decisions the C-Suite may need to make in the future e.g., whether to stop production of a particular product line etc. It is also important that the C-Suite understand the impact that QRFs should have on the planning process, making it easier, quicker and more realistic.

As a minimum, I suggest a half-day workshop, where the entire executive team meets to receive presentations by experts, organisations with rolling forecasts, and an in-house team who are the recognised candidates to lead such a project. After this meeting, the C-Suite will be able to either commit to it or put it back simmering on the company’s “slow cooker”.

By commitment I mean the C-Suite will need to set aside time to give feedback on suggested drivers, visit QRF sites, and approve the investment proposal to acquire the chosen planning software, all in a tight time frame.

The benefit of this action: The C-Suite will be in the best position to make the correct decision, which is the investment in planning software. Also, the C-Suite will be able to play their part in an efficient and effective rolling forecast process.

Lesson 3: Progress through stealth

Successful planning requires more than implementing the perfect planning tool. You must also replace the annual plan with a quarterly forecasting and planning regime, where the four updates are completed in less elapsed time than the existing annual planning process. However, to implement this change, “progress by stealth” might be the best way forward unless your CEO is leading the “beyond budgeting” charge.

What I mean by this is that you first justify purchasing the planning tool for a more accurate annual plan, better forecasting and its month-end reporting capability. Then, when the forecasting system is running well, you start implementing some of the beyond-budgeting techniques such as quarterly rolling funding. At a later stage, senior management might well want to remove the annual process completely.

The benefit of this action: Not all the C-Suite and Board will see the light at first. Let them see the advantages of the next steps as the project delivers.

Lesson 4: Select a small team

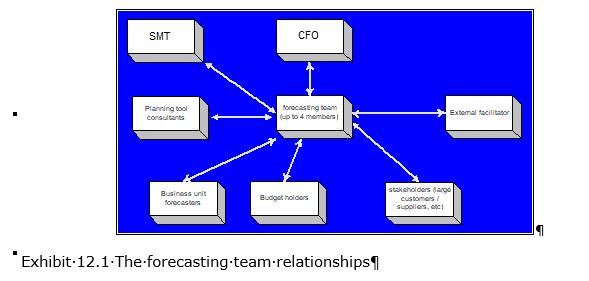

It is important to select a small team to work on this project. The project team will be supported by project co-ordinators at the different business units, see Exhibit 12.1 These co-ordinators need to be knowledgeable about their business unit’s operation and be available to provide knowledge and to give feedback about their area to the project team members.

I recommend a team of between 2-4 staff for the rolling forecast team. It is important that you ensure the team has the appropriate mix of skills including: they are self-starters, innovative, good at presenting, finishers, in-depth organisational and sector knowledge, experience using the general ledger, advanced communication skills and the ability to bring others on board. It is unlikely that you would get all the skills covered with just two staff.

The project team members need to be committed nearly full time to this project. You certainly will not complain if the project finishes earlier.

My suggestion is to find those oracles who know the business well. In your organisation team them up with your “top guns”, your young, fearless and precocious leaders of the future who are not afraid to go where angels fear to tread.

It is also best to ensure that the team is free of a well-meaning C-Suite member, who whilst enthusiastic will be forever cancelling meetings. The C-Suite involvement should be left to an advisory capacity.

The benefit of this action: The project team can deliver and the time to do it.

Lesson 5: Don’t get too complex – avoid the rocket scientist

Forecasting in detail does not lead to a better view of the future. Forecasting at a category level, not at the account code level. Changing the mindset in the business and at the C-Suite level from the detail to a level that is right for the business.

Many of the extreme examples of Excel models have been designed by accountants and planners who always wanted to be a rocket scientist. They create monster models which only they could possibly understand, ending up with the organisation, which is a living nightmare, which may include any of the following: weeks or months of work on the model each time it is used, poor version control, consolidation headaches, low-level confidence in the resulting numbers and emails and phone calls to the model builder who may well have left the company, need I go on!

The project team should avoid a rocket scientist in both the team itself and in the consultant who is advising them.

This lesson is so important that I have made it one of the five foundation stones[i] of implementing a planning tool.

The benefit of this action: A model that is based on the key numbers.

Lesson 6: Find an external facilitator

The project team will need a facilitator who can help guide them in the development of the blueprint, and the scoping document for the planning tool. This will normally be performed in workshops.

The facilitator will also act as a mentor ensuring that the project team maintain a “helicopter view” of the project, avoiding getting lost in detail. And be a safety net in case the planning tool’s consultants start leading the project team “up the garden path”.

The facilitator’s role on a project such as this should be somewhere between 25-35 working days.

The benefit of this action: Keeping the team building a model on the foundation stones.

Lesson 7: Selling through the “emotional drivers” and the necessity for public relations experts

Nothing was ever sold by logic; sales are made using emotional drivers e.g., remember your last car purchase? Many finance team initiatives fail because we attempt to change the culture through selling by logic and issuing commands. It does not work. This project needs a public relations (PR) machine behind it. No presentation, email, memo, paper should go out unless it has been vetted with the help of a PR expert. All your presentations should be tailored to suit the different audiences’ emotional drivers, and these should be road-tested in front of the PR expert.

I believe you could contract this service in for less than four days of fees for the whole project. You will never regret it.

The benefit of this action: Better chance of selling the change process.

Lesson 8: Ensure you have at least four experts on the new system in-house

Select at least four in-house staff to become experts on the forecasting system (do not forget the CFO). Over time you will find these staff will be head hunted so always maintain this level of in-house competence. Not only will this save you money in the long run you will have the system you need.

Many programmers working for application providers are not familiar with quarterly rolling planning. They will build you a better annual planning tool, which is not what you will need.

The benefit of this action: Adequate staff cover to cover the eventual loss of some of these highly sought-after “planning tool” savvy accountants.

Lesson 9: Design the forecasting and planning model yourself – do not let a third party do it for you

The project team must always design the model themselves. You need to use the planning tool consultants more as advisors and trainers and make sure you drive the mouse. The planning tools are relatively simple to use providing the in-house staff have attended in-depth training.

If the model is built by the consultants, not only will the project cost infinitely more money, but you also have the added risk of bringing someone who may not fully understand your business, and who will endeavour to build you a better annual planning model; this is the very thing you need to migrate away from.

An in-house team has a better chance of designing a working model that fits your industry and your decision-making processes than an external consultant. Consultants, with the best will in the world, cannot help designing a model based on their prior experiences, which may be adrift of better practice techniques.

In other words, it’s just like driving a car, the team will need a series of lessons and hopefully practise it on “quiet country roads”, before they let rip into the main model.

The benefit of this action: A model that fits your industry and your decision-making processes.

Lesson 10: Forecast some of the key ratios the business uses

Any view of the future should include a forecast of some of the key ratios you use in the business e.g., gross margin, direct labour costs to revenue, distribution costs to sales etc.

These ratios are a useful check of reasonableness providing the ratios have not been used in the forecasting process already. If they have they are a meaningless check.

The benefit of this action: The validity of the model can be checked quickly.

Lesson 11: More ownership and use across divisions (more licences)

Companies have, to save money, centralised data input within the finance function. This has been a big mistake. It has slowed down the forecasting process, limited buy-in from BHs to the model and allowed Excel spreadsheets to still litter the organisation.

It is important to ensure that budget holders are entering directly into the model. This will mean that there must be training and adequate support from the forecasters and enough licences purchased so budget holders can enter data into the model during the two/three-day window for data entry.

The benefit of this action: The planning tool is the only source of the truth.

Lesson 12: If a planning tool accompanies your GL package you will still need to compare it against other solutions that are available

Many large accounting applications have a suite of tools. One of these tools will be a planning tool. Before you jump in check out what is available in your price range as:

- The packaged deals are seldom the best in their field

- All planning applications can accept data from any G/L

- The simpler planning tools may be a cheaper and better option

The benefit of this action: More cost-effective planning tool.

[i] David Parmenter. “How to implement a forecasting and planning tool– and get it right first time , Whitepaper, www.davidparmenter.com, 2014

For more details access my implementation guides that currently is on sale:

These 12 lessons are discussed in great length in my implementation guides How to Implement Quarterly Rolling Forecasting and Quarterly Rolling Planning – and get it right first time // implementation guides (Whitepaper + e-templates)

You can have a look inside the implementation guide

Also read: