Your cart is currently empty!

4 rules for accurate revenue forecasting

By David Parmenter

“The basic building block of any forecast is the sales or income line. Most other variables are related to sales. But obtaining an unbiased sales forecast is no easy task. A well-prepared sales forecast should take account of marketing and promotion and new product launches. It should consider market share, production capacity, and competitive actions. And it should examine customer behaviour patterns.”

Jeremy Hope and Steve Player[i]

With over 200 products and 2,000 customers how do you reasonably obtain an accurate sales forecast? The answer lies by:

- applying Pareto’s 80/20 rule to the sales forecasting process.

- using the wisdom of the crowd

- decoupling sales performance payments from fixed annual performance targets

- tell the Board what sales are likely to be made rather than what they want to hear

1. Applying Pareto’s 80/20 rule to the sales forecasting process

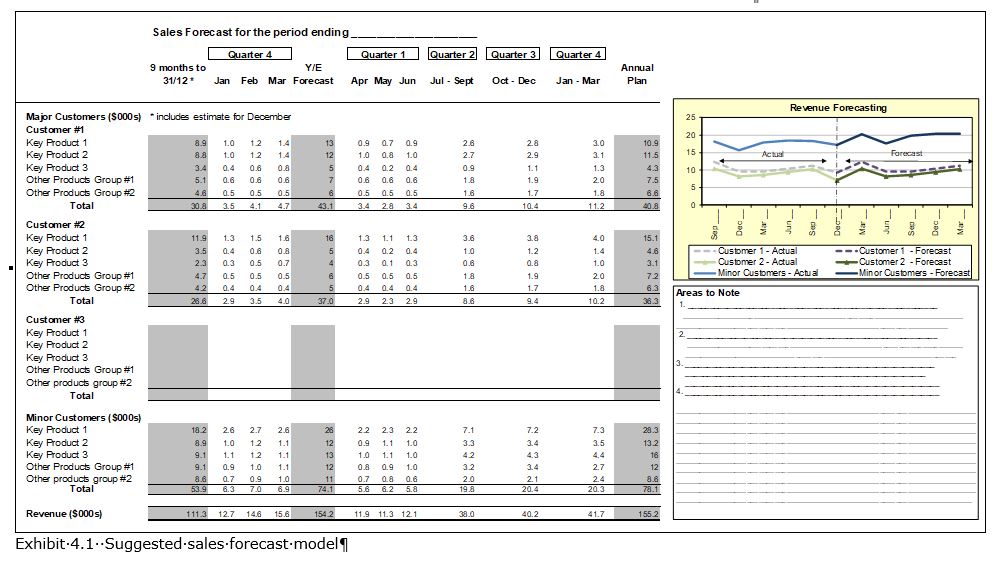

Sales need to be forecast by major customer and major products. The rest of the customers and rest of the products should be put into meaningful groups and modelled based on the historic relationship to the major customers buying patterns. See Exhibit 4.1 for a suggested format.

Many organisations liaise with customers to get demand forecasts only to find them as error prone as the ones done in-house. The reason is that you have asked the wrong people.

ASKING THE RIGHT PEOPLE AT YOUR MAIN CUSTOMERS

One participant told me that they decided to contact their major customers to help with demand forecasting. Naturally, they were holding discussions with the major customers’ HQ staff. On reflection, they found it better but still significantly wrong, so they went back “How come these forecasts you supplied are so error prone”. “If you want accurate numbers you needed to speak to the procurement managers for our projects” was the reply. “Can we speak to them?” “Of course, here are the contact details of the people you need to meet around the country” With that a series of meetings were held around the country. They found that these managers could provide very accurate information and were even prepared to provide it in an electronic friendly format. The sales forecast accuracy increased seven-fold due to focusing on getting the demand right for the main customers.

It is always best to approximate the size of the forest rather than count the trees and recant the analogy of counting the trees, see previous section, to the forecasting team to ensure you stay in the “helicopter” for the revenue forecast.

Major lessons learnt include:

| Major customers | You can forecast revenue more accurately by delving into your main customers’ future demand patterns by asking them “who should we speak with to get a better understanding of your likely demand for our products in the next 3 months and subsequent five quarters.” Forecast the major products line-by-line. You would not identify a product if the revenue was less than 5% of total sales in the year. Using analytics then forecast the minor product purchases in relevant groupings. |

| The other customers | Forecast all non-major customers by first looking at their demand for the major products using analytics to forecast their demand. As with major customers use analytics to forecast the minor product purchases in relevant groupings. |

| Products with recall risk | Identify in the forecast all products with a significant recall risk so you can quickly identify these, and the impact should a recall occur. |

| Branches | Important to forecast through the major customers to the organisation. One branch may be assigned the responsibility to link to the customer and complete the forecast for all relevant branches. |

See Exhibit 4.1 for a suggested format for forecasting sales by major customer and major products.

2.Using the wisdom of the crowd

The theory of “the wisdom of the crowd”, as discussed in the previous foundation stones section, was tested by Best Buy, a leading US consumer electronics retailer with these results:

- Gift card business revenue forecasts made by experts were 95 percent accurate and the wisdom the crowd revenue forecasts were 99.5 percent accurate.

- Holiday season sales revenue forecasts made by experts were 93 percent accurate and the crowd’s revenue forecasts were 99.9% accurate.

As a result, at Best Buy the forecasts are now prepared by asking selected “sages” in the business to provide an anonymous forecast directly into a system. They are provided with some basic trend information with the incentive of the recognition and a prize if their forecast is the nearest to the actual figure.[ii]

In another example, an internet gambling organization had picked the winner in each one of the US Senate elections. The favourite in each state was a direct reflection of all the bets placed and a perfect representation of collective wisdom of the crowd.

CONVINCING EXPERTS TO ADOPT COLLECTIVE WISDOM

Resistance from “experts” is likely when you suggest using the wisdom of the crowd in place of their forecast. To convince them, you can take a page from Best Buy’s book. Suggest two forecasts: theirs and one by selected sages from around your business. Ask the sages, to forecast sales for the whole organization based on what they are seeing in their areas. You can tell them, “We have prepared some historic data for you and limited the forecast to some key lines and the rest is summarized in groups. Please place your forecast in the system. If your forecast turns out to be the most accurate you will win a weekend for two at xxx resort.”

Each quarter, you then disclose the experts’ forecast versus actual and the wisdom of the crowd versus actual. I predict that the experts will want to duck for cover after a couple of forecasts highlight their inaccuracies. They will ask, even plead, “Please put our forecast in with the wisdom of the crowd.”

The wisdom of the crowd has implications on the design of the planning tool. You can expect to accommodate possibly 20 versions of the revenue forecast and then average them. This, however, should not be a problem because you are not forecasting revenue by each line and by each branch.

3.Decoupling sales performance payments from fixed annual performance targets

Jeremy Hope warned us that bias was a major problem with forecasts.

Too many forecasts are prone to bias. Many companies, for example, rely far too heavily on the opinions of salespeople and managers, rather than use hard data. These opinions tend to distort results because people confuse targets (hope) with forecasts (reality). They also tend to produce forecasts for their own functions and mistrust forecasts from other areas, overestimate the effect of marketing campaigns and other revenue-management actions, and use forecasts that differ from those used in other parts of the company. Jeremy Hope and Steve Player [iii]

To pay sales staff on a predetermined annual sales target has been broken since commerce began. It is flawed logic and will only work when you can see into the future and get it right. I would suggest that if this was so you would already be retired in a tax haven with a super yacht and crew awaiting you next excursion. It is far better to:

- design a relative measures process where sales staff are compared against their peers with similar sized sales patches (have different league tables)

- compare regularly to your competitor’s performance so any loss in market share is seen as inferior performance regardless as to whether sales are higher than last year (you will need to use test proxies for this)

- provide regular feedback to sales staff as to their progress, just like the high jumper who knows how far off they are from leading the high jump competition.

- skim off super profits as these will be needed in future years to pay commissions and were not earned anyway as the phone just kept on ringing. Visit my website for a performance related pay paper.

If we do not decouple sales performance payments from fixed annual performance targets you will have a fair degree of politics at play during and after the annual planning process. You will have:

- endless arguments about how high to set the bar

- once set it is best for the sales team to keep on saying they can make it rather than attract unnecessary heat for the executive

- month-end revenue figures will be manipulated as next month’s revenue is pilfered to meet this month’s target.

4.Tell the Board what sales are likely to be made rather than what they want to hear

This foundation stone needs to be put in place to avoid inflated sales forecasts. There is nothing wrong in having a big hairy audacious goal, doubling revenue in the next three years, provided forecasts are not forced to make it look like it is a reality.

[i] Jeremy Hope and Steve Player, “Beyond Performance Management: Why, When, and How to Use 40 Tools and Best Practices for Superior Business Performance” Harvard Business Press, 2012

[ii] Michael J. Mauboussin, Think Twice: Harnessing the Power of Counter intuition. Harvard Business Review Press, 2012

[iii] Jeremy Hope and Steve Player, “Beyond Performance Management: Why, When, and How to Use 40 Tools and Best Practices for Superior Business Performance” Harvard Business Press, 2012

For more details access my implementation guides that currently is on sale:

The 4 rules for accurate revenue forecasting are discussed in great length in my implementation guide How to Implement Quarterly Rolling Forecasting and Quarterly Rolling Planning – and get it right first time // implementation guide(Whitepaper + e-templates)

You can have a look inside the implementation guides

Also read: